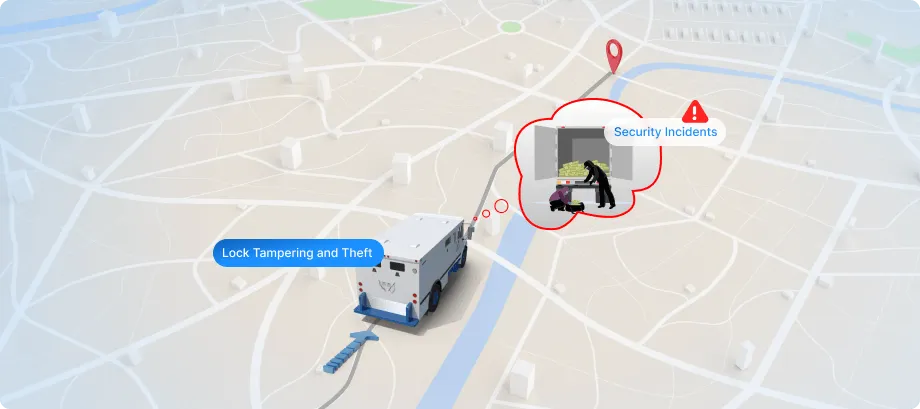

ATM and bank cash carry vans are responsible for transporting cash and other valuable items between banks, ATMs, and other financial institutions. Given the high value of their cargo, security is of utmost importance, and any loss or theft can have severe consequences. E-lock software is a solution that can help secure these vehicles and ensure that the cargo is protected at all times.

Our E-lock software provides a solution to these challenges

Formatting Form...